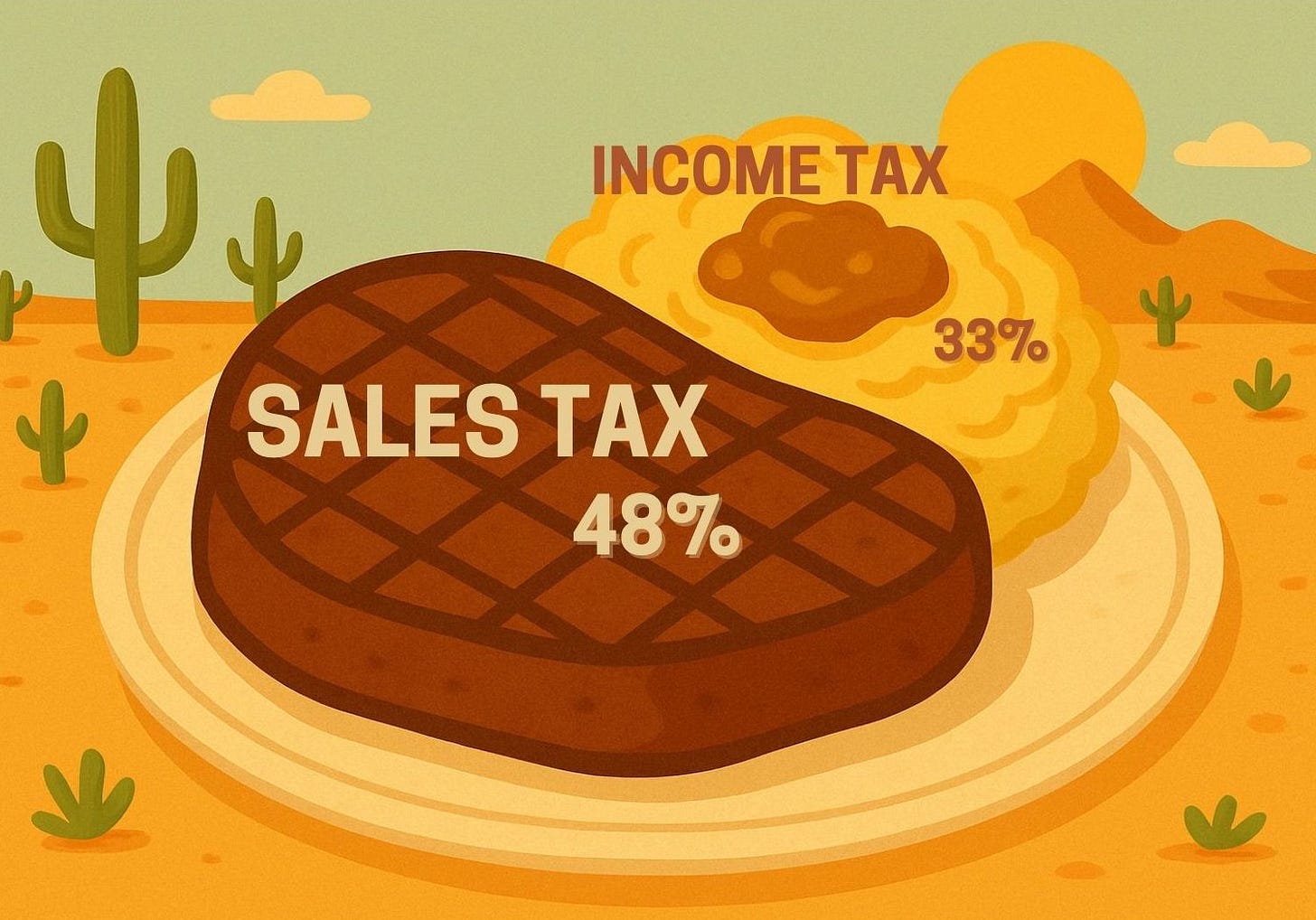

The meat and potatoes of taxes

Where your tax dollars dine … All crisis, all the time … And we’re gathering bad typo karma.

Congratulations! You made it through tax season.

No one enjoys the annual exercise of figuring out how much you owe the government.

And we’re not sure any lawmakers enjoy the annual exercise of figuring out where our tax dollars should go.

We turned Arizona’s General Fund into a steak dinner to illustrate where most of your state taxes go.Like most years, legislators don’t seem to be in a hurry to pass the state’s annual budget as funding for children with disabilities runs out and the future of a program that provides hundreds of millions of dollars to public schools remains undecided.

We’re in the awkward turning point of the session when lawmakers are voting and amending the last few bills to send to the governor’s desk as the behemoth task of passing a state budget lurks in the background.

Passing the budget is one of the most important things lawmakers do every year. It’s a multi-billion-dollar representation of what our elected officials prioritize — and the whole thing plays out behind closed doors.

The basic idea of taxation and representation comes down to electing people who will use your tax dollars the way you want.

But the public doesn’t get much of a say in the biggest annual allocation of its money. Legislative leaders only introduce budget bills after they believe they have enough votes to pass the deal outlined in budget docs.

So before news drops of how Arizona plans to spend your tax dollars this year, we’re breaking down major funding sources making up those dollars that come directly from Arizona residents.

And we love a good metaphor, so we’re explaining Arizona’s greatest tax revenue sources as a steak dinner: There’s the meat, the potatoes and a little dessert.

Today, we’re focusing on how most of your tax dollars are collected within the state’s $17 billion General Fund — the main course, if you will. It’s kind of like the state’s main bank account, and it funds more than 60 state agencies.

The meat and potatoes

Sales tax

Deposited into General Fund: $7.9 billion.1

Percent of General Fund: 48%

Unlike income tax, you pay your sales taxes every day.

And that 5.6% you pay every time you order a burger or pick up laundry detergent is literally holding the state’s finances together.

Last year, the state revenue department reported collecting $10.3 billion in sales taxes, which filled more than half of the state's General Fund.

But technically, you're not the one paying the tax.

It’s actually the In-N-Out or Walmart that has to pay that sales tax, which in Arizona is called a transaction privilege tax. That’s a fancy way of saying a vendor has the “privilege” of doing business here, so they have to pay the state for the sales they make. The businesses pass that cost on to consumers.

Most cities leverage their own sales taxes, which drive up the total you pay at checkout. In some cities, you'll pay up to 11% sales tax.

Individual Income Tax

Deposited into General Fund: $5.5 billion

Percent of General Fund: 33%

Republicans passed Arizona’s largest tax cut in history when they implemented a flat income tax in 2021. Then-Gov. Doug Ducey approved a 2.5% maximum tax on everyone’s paychecks, no matter how much they make in a year.

It was a stark departure from the state’s graduated income tax scale that went up to 4.5% for someone who makes more than $159,000 a year.

In the 2022 election, opponents of the flat tax got enough signatures to give voters the say if the flat tax should go into effect, but the state Supreme Court said voters don’t have a say on tax legislation.

Economists on the Joint Legislative Budget Committee, a group of economic intellectuals who track the state’s revenue streams and advise lawmakers, said the “primary culprit” behind last year’s $1.7 billion deficit was the flat tax finally taking full effect.

That stark drop in revenue has hit cities hard. About 18% of state income taxes are shared with local governments, and Phoenix’s City Council recently raised its sales tax rate from 2.3% to 2.8% because of revenue lost to the flat tax.

Republicans aren’t ready to stop there, however. They’re advancing a measure this year to automatically cut income taxes if budget analysts calculate a surplus. Gov. Katie Hobbs is against the proposal, but Republicans plan to send it to the voters.

And voters typically like cutting their own taxes.

The veggies

Corporate Income Tax

Deposited into General Fund: $1.7 billion

Percent of General Fund: 10%

Most corporate entities have to pay taxes on the money they earn in Arizona. That’s usually about 5% of their profits, but businesses can bring that down to 2.5% by reporting income tied to their shareholders. It’s a convoluted process that results in corporations paying the state less.

Overall, the taxes are a pretty volatile funding source. Corporate income taxes are tied to market conditions, and there are confidentiality laws that obscure some of the data on them.

But there’s a lot of ways businesses can reduce their tax bill through tax credits.

Corporations can pay less for increasing the number of people they hire, installing solar panels or selling coal, for example. In tax year 2022, Arizona’s corporations got an estimated $209.8 million worth of tax credits, per the state Department of Revenue.

Insurance Premium Tax (IPT)

Deposited into General Fund: $756.7 million

Percent of General Fund: 5%

Arizona taxes insurance companies on the amount of premiums they collect from state residents. That includes what you pay into car, life and health insurance.

The standard tax rate is about 1.7%. Most of those collections go into the General Fund, but a portion of taxes on fire insurance premiums go back to local fire departments, and part of car insurance payments go toward the pensions of highway patrol personnel.

Dessert

Tobacco and Liquor Taxes

Deposited into General Fund: $64.5 million

Percent of General Fund: >1%

Arizona imposes “luxury” taxes on alcohol and tobacco products, because apparently having a beer and cigarette isn’t an essential service.

The combined tax rate for every cigarette someone buys in Arizona, that’s not on a Native American reservation, is 10 cents. That’s about $2 per pack of 20 cigarettes, but it differs for things like cigars and chewing tobacco.

Different types of alcohol are also taxed differently — liquor is taxed at $3 per gallon, and malt liquor is 16 cents per gallon, for example.

All that money props up the General Fund, but it also goes into other programs like Early Childhood Development and the Drug Treatment and Education Fund. The Arizona Department of Revenue reported collecting $345 million worth of liquor and tobacco taxes last fiscal year.

Constitutional crisis: Despite a unanimous U.S. Supreme Court decision that President Donald Trump must “facilitate the return” of a man who was erroneously deported without due process to the notorious El Salvadoran torture prison to which he was sent, Trump has done nothing to facilitate Kilmar Abrego Garcia’s return, his lawyers argued, per ABC news. Trump and the president of El Salvador offered a collective shrug at the Supreme Court in a meeting Monday, NBC notes. Legal scholars say this is the definition of a constitutional crisis. Meanwhile, Trump is now threatening to deport AMERICAN CITIZENS to El Salvadoran torture prisons.

What’s the plural of crisis?: Trump is still denying the Associated Press access to the White House and presidential events, despite a court order mandating Trump stand down from his war on the world’s largest wire service, the AP reports. Trump is barring the AP because it refuses to update its stylebook — upon which most newspapers rely — to call the Gulf of Mexico the “Gulf of America.” Meanwhile, Trump wants to take “60 Minutes” off the air by revoking the broadcast license of CBS after the show did a pair of segments he didn’t like, per The Hill.

One more for good measure: A judge in Vermont is openly questioning whether the Trump administration would even follow his orders if he tells them to return a Tufts University student who had written a pro-Palestine oped and was nabbed off the street by plainclothes immigration officers. Rumeysa Ozturk is currently being held in a Louisiana detention center but the judge is considering ordering her back to Vermont, where she was previously detained, per USA Today.

Arizona man: As Trump continues his war against law firms he dislikes and threatens their clients, he’s relying on an Arizona lawyer who was indicted as part of the 2020 fake elector scheme to steal the presidency, per the Washington Post. Boris Epshteyn is negotiating with the law firms on Trump’s behalf, despite never having worked for the government, never having tried a criminal case and still using a Gmail address. Epshteyn was also arrested for repeatedly groping women at a Scottsdale night club in 2021, per the Republic, which has video of the arrest. It was his second arrest at a Scottsdale bar.

Start your engines: Former Pima County Supervisor Adelita Grijalva, former state lawmaker Daniel Hernandez and social media activist Deja Foxx all filed well above the minimum number of signatures to run for Southern Arizona’s Congressional District 7 to replace the late congressman Raul Grijalva. Democrats Jose Malvido and Patrick Harris also filed signatures to qualify, but they cut it close enough that we could see challenges to their nominating petitions in the next week. A few Republicans also filed, but don’t stand a chance in the Democratic stronghold. The primary is scheduled for July 15.

Not a waste or a nuisance: Arizona reuses about half of its wastewater — which is pretty good, but not as good as Nevada, which reuses more than 80%, the Daily Star’s Tony Davis writes, based on a UCLA report. California only reuses a little more than 20% of its wastewater. Fondomonte, the Saudi-owned alfalfa farm that has become symbolic of Arizona’s water debate, told a judge that the farm is not a “nuisance,” as Arizona Attorney General Kris Mayes alleged in a lawsuit, Capitol Media Services’ Howard Fischer reports. Lawyers for the company argued that state law says agricultural operations with good practices are “presumed to be reasonable.”

Good golly: The Arizona Corporation Commission is looking into data centers’ high energy use, trying to ensure that consumers aren’t subsidizing costs for data centers, KTAR’s Heidi Hommel reports. Arizona data centers are consuming 67% more energy this year than last.

We’re also burning lots of energy writing this newsletter for you. Help fill our tanks by upgrading to a paid subscription today.

Good news: Arizona still doesn’t have a single case of measles this year, which is somewhat surprising given our proximity to Texas and generally low vaccination rates, Cronkite News’ Madeline Bates notes. Experts say it could have something to do with having older residents (measles thrives on kids) and general lack of human density (it’s an airborne disease). So far, 22 states have had at least one case, and last year, Arizona had six, per Bates.

Good law: During the pandemic, Arizona state legislators changed the law to allow veterinarians to start offering virtual visits. And now, the Arizona Humane Society is offering telemedicine appointments for pets, KJZZ’s Kirsten Dorman writes.

Arizona invented the school voucher model. Now other states are replicating it — and the receipts are wild.

Georgia planned for 22,000 students and a $144 million price tag. Then someone realized the way the law was written could make 400,000 kids eligible.

Texas GOP leaders are purging lawmakers who dared to vote against vouchers.

And Ohio’s already half a billion dollars deep and increasing its voucher spending.

Subscribe to the Education Agenda for today’s edition on school vouchers — and bring a calculator.

The Washington Post has a cool story about hunting for meteorites in the Saharan Desert that quotes an Arizona meteorite collector who finds some of his best space rocks in Northern Africa.

It’s one of those big glossy stories with four bylines, lots of great photos and a brief intro talking about how the reporters “covered hundreds of miles of road and desert tracks in remote parts of the Sahara, meeting scientists, meteorite brokers and rock-collecting herders along the way.”

Unfortunately, it was mired with one small correction: They mixed up “astronomy” with “astrology.”2

These figures come from the Joint Legislative Budget Committee’s FY 2024 Appropriations Report

We know it’s terrible luck to laugh at typos. But we just couldn’t help ourselves today.

This is the reason so many people hate Chump. He thinks the Constitution is just a triviality. Due process is a nuisance. If they would just send a plane down to get this guy back...the problem is resolved...for now. What a bunch of jerks.

Regarding ESAs and today’s Education Agenda, a common theme across all states is that supporters of ESAs misrepresent the up front costs of these programs.

Arizona would have at least an additional $300 million this year to support more important needs if the state did not send taxpayer funds to students that were already enrolled in private school.